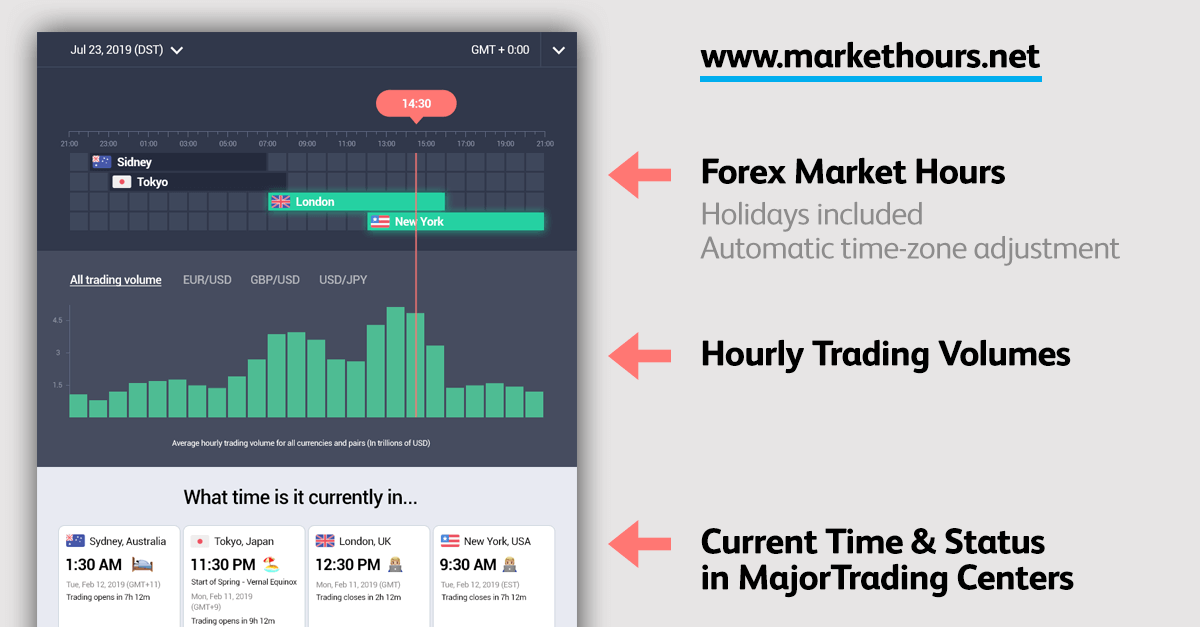

Uncover what is the best and worst time to trade forex. See forex market trading hours at a glance. Check when the forex market opens and closes in London, New York, Sydney, Tokyo. Your time zone is adjusted automatically! Unlike with other tools - national bank holidays and weekends are taken into account.

Liquidity shows how active a market is. A currency pair has a high level of liquidity when it is easily bought or sold and there is a significant amount of trading activity for that pair.

During periods of reduced liquidity, currency rates are subject to more sudden and volatile price movements.

The spread is a commission that brokers charge you for making a trade. It is the gap between the bid and the ask prices.

Volatility describes the level of moves of an exchange rate.

When only one market is open, currency pairs can get locked in a tight band of ~ 30 pips of movement.

Two open markets at once can easily push the movement to more than 70 pips, especially when big news are released.

A pip is the smallest measure of change in a currency pair.

As most major currency pairs are priced to four decimal places, a pip is usually $0.0001 for currency pairs with the US dollar.

It was a rainy day in October when we got fed up with all the faulty forex market hour charts.

To use one, we had to calculate the conversion from a different time zone.

Another one had a dropdown with hundreds of time zones. However, it had no search function, so we had to scroll endlessly.

The third one did not take the daylight savings transitions into account… Moreover, most of them did not show up-to-date holidays when the markets are closed or have little activity.

"Screw this mess!" we thought and set out to build our own tool which solves the shortcomings of the others.

It's still in beta, so please let us know if you find any issues or have ideas for improvement.

Have you ever Googled, "When is the best time for trading?"

If you do, you will notice that most of the resources are saying the same thing:

"The best time to trade is during the London/New York overlap and other times of high market volatility."

It sounds so nice and simple. But guess what?

A research study of 24 million real trades showed a surprising fact - this approach is wrong for a large number of traders!

It turns out that most traders are range traders (read along to see if you're one of them) who could increase their likelihood of success from 47% to 55% if they traded during lower volatility times instead of high volatility periods.

Contrary to what others may tell you, there is NO universal best time for trading!

The best times depend on what type of trading you are planning to do.

Times of peak market volatility might be good for some strategies and not so good for others.

There are three major types of forex trading strategies:

And here are the appropriate best trading times for each of these trading types:

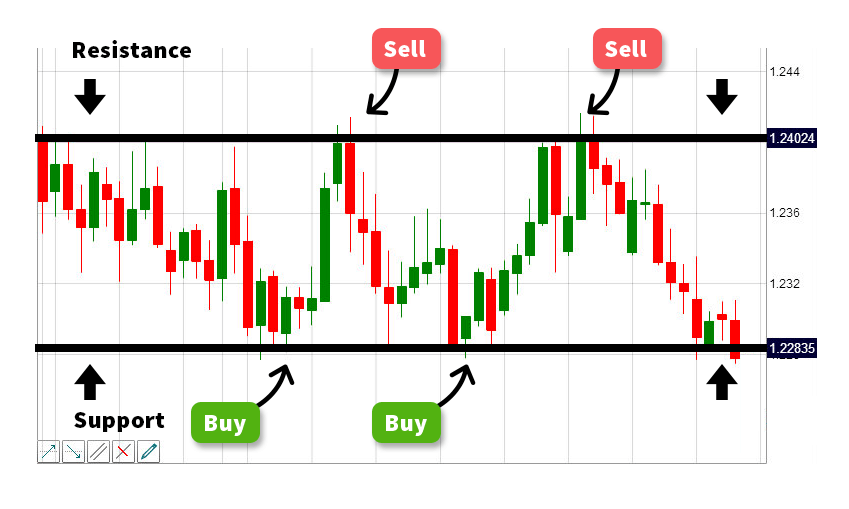

Range Trading works best if a price is moving within relatively narrow ranges and is not breaking through the support or resistance levels.

This is usually the case during the quiet Sydney and Tokyo session hours.

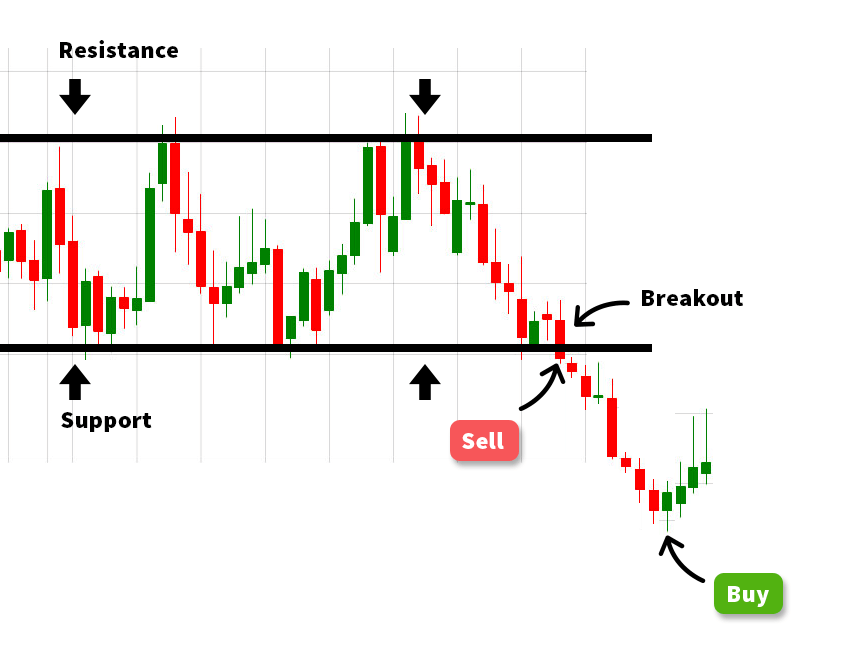

The goal of a breakout trade is to enter the market right when the price makes a breakout from a previous range and then continue to ride the trade until the trend diminishes.

A sign for a potential breakout can be found using technical analysis or by anticipating or reacting to news.

Certain times can be especially challenging to make money in the forex market.

These times include the days before, during and after a major international holiday, such as Christmas or New Year’s.

Major bank holidays in the United States, the UK or Europe can also adversely affect trading volumes, often leading to sharp moves in thin markets that can trigger Stop-Loss orders.

For most traders, the following are among the worst times to execute forex trades:

And now comes the big one - on weekends, the forex markets are closed for trading, but rollover interest is still being counted. As per industry standards, brokers apply an interest equal to 3 days of rollover on Wednesdays.

However, there are some brokers who unify the rollover fees so traders pay the same amounts for every night from Monday to Friday.

For those who don't keep trades open during the night, (intraday traders) rollover is not a concern. If a position is opened after 5:00 PM (New York time) on the previous day and closed before 5:00 PM (New York time) on the current day, then no rollover is credited or debited.

Before trading, it is wise to check the rollover terms of your chosen broker.

A stop-loss order protects you from losing more than you are willing to risk. Before opening a trade you can specify a price level at which your position will be automatically closed.

There can be two types of stop-loss orders:

Usually, you can't. The forex market is closed for retail traders on weekends.

The currency market closes on Friday 5:00 PM New York time (10:00 PM London time), when the New York session finalizes, and reopens on Sunday at 5:00 PM New York time (10:00 PM London time).

But…here's the catch #1: The FX market is not closed for everyone! Central banks and related institutions can keep pushing around billions, even on weekends.

Also, when a huge transaction takes place during the weekend, it can create a thing called the weekend gap, which can cause your stop-losses to get triggered and your position to close.

If, on Sunday, the opening-price is higher than Friday’s high price price, you will have a gap up. If the price opens lower, you will have a gap down.

That's why traders usually either set wider stops or close their positions entirely over the weekend.

And here's the catch #2: Some brokers allow you to trade even during the weekend, but spreads will be much bigger during weekends when liquidity is super thin or almost non-existent.